We're approaching the end of the year (at the time of writing and publishing) – a time to look back and review your successes and opportunities for improvement with an eye on goals to achieve in the next year. An important part of this process is thinking about your budget – specifically, how much should I invest in marketing to drive growth?

Wow – what a question!

In a recent Marketing Masterclass, we partnered up with the fabulous Arlene Moss, Executive Business Coach with the XY Planning Network, to dig into why a marketing budget is essential for growth and how to calculate your practice's unique budget.

Spoiler alert – there is no one-size-fits-all marketing budget to drive growth. To complicate things more, as Arlene points out, many advisors have no idea how much they should spend on marketing. In fact, this is the number one question we get from advisors, whether they're solo practitioners, part of a bigger organization, just getting started, or an industry veteran.

This industry is filled with people who love math, and folks often want a straightforward answer when it comes to numbers. Most firms spend 1-2% of revenue on marketing. We see our clients are more in the 6% range. So, is this the number? It could be, but to provide an even more thoughtful approach, we’d like to offer an alternative path to calculating your marketing budget that aligns with the growth you want.

How to create your marketing budget to drive growth

When you start thinking about your marketing budget, you need to consider two questions:

- How many clients do I want?

- And how much am I willing to spend to get them?

These two seemingly simple questions can help fuel your strategy profitably by defining your goal and an estimated budget. However, as we get into the calculations, you'll see that your initial estimate may be more frugal than needed.

Strategy first

First things first – when you're thinking about your firm’s budget, it's important to align this decision with your strategy. Everything you do, every cent you spend, needs to align with what you offer – the change you create for people – and the audience you're trying to connect with.

We see a lot of impact when an advisor identifies their number and uses it to fuel their strategy. As Arlene shared during the recent Marketing Masterclass, "Schwab did a study, and they found that firms with a written marketing plan, an ideal client persona, and a solid value prop are attracting over 40 more new clients than firms that didn't have all those things in place. Having a budget gives you even more confidence in spending what you need to follow your plan and reach your growth goals."

The math

So, let's get into some math and answer that question – what should my budget be to drive the number of new clients I want?

We’d offer an approach that is less about defining the percentage of revenue you should spend and more related to a client's lifetime value (LTV). We want LTV to be greater than the cost to acquire (CTA). A more intuitive approach – we don't want to spend more than we make while working with clients.

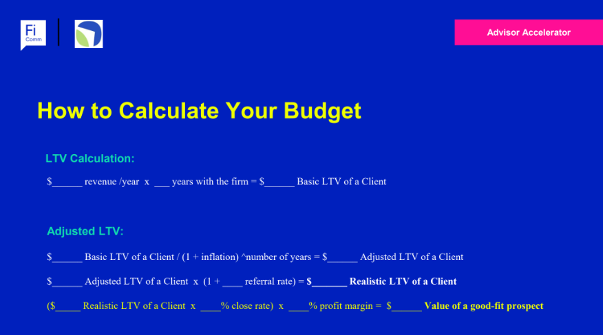

Think about the lifetime value of your client and, therefore, what might you spend to acquire them. The basic formula is straightforward. It's revenue per year, times the number of years with the firm, to determine your basic lifetime value.

Of course, we also need to account for inflation and the cost of referrals to calculate an adjusted, realistic LTV. The image below shows the formulas you need to follow to determine the value of a good-fit prospect. Once you have that number, multiply it by your target number of new clients to calculate your annual marketing budget.

As you're thinking about the math, you're also considering how much you're willing to spend to get the clients. And how to do it profitably. We want to share a couple of milestone numbers to get a rough idea of a typical spend. We've seen advisors come out with around a $20,000 value of a good-fit prospect. That's a very reasonable potential outcome.

Or, as Arlene put it, "It's exciting, right? A prospect is very valuable to my firm. If they are a good fit and I've done smart marketing to attract the right people, I can spend $20,000 and still be a profitable firm. Wow! Right? So, the math is actually very exciting in most cases when I've seen it play out."

Based on this calculation, what are YOU willing to spend on a good-fit prospect? If you have questions about budgeting to supercharge your firm's growth, ask our team at FiComm. Send in your question through Dear FiComm, and we'll help you for FREE!