If you’re trying to scale your business, how much more do you need to spend on marketing? Profitability consultant Brandon Gray has shared a shockingly simple metric for assessing the effectiveness of your marketing budgets. That metric has had a profound impact on my own business, and on our clients’.

If you spend more on marketing next year, will you achieve the growth you want—or just waste your money?

It’s perfectly sensible question, but it’s very hard to pin down an answer. You can easily end up going down a rabbit hole of site traffic, click-through-rates, keyword rankings, cost per clicks and lots of other statistics without getting any clear, actionable information.

I’m going to give you a simple answer. And it’s a hard, specific number, not a vague suggestion. Ready?

It’s 50%.

For every extra $1.00 you spend on marketing, you should expect profits—not revenue, mind you, but profits— to increase by 50 cents.

If it happens, good job. Test spending even more. If not, cut back.

It’s such a simple framework. But it can change your business forever.

Based on proprietary, real-world data—not theory.

Let’s step back and discuss where this number comes from and what it means.

Brandon Gray of Simple Numbers CRI is a profitability consultant to entrepreneurial businesses, as well as a great friend of FiComm. His insights have been transformative for me, and for FiComm clients, in terms of giving us elegant and easy-to-use frameworks for making business decisions. I talked to Brandon recently about his approach.

The 50% figure comes from his team’s 100-Company Model—a compilation of real-world data from Simple Numbers’ clients, which span every sector and geographical location. The model shows that on average, entrepreneurial companies that generate around 10% profit to revenue typically show a return on equity averaging around 50%. (Brandon defines equity as all receivables, cash, and assets, minus debt.)

The thinking behind the approach seems obvious once you hear it.

A 50% return on invested capital is an awesome payback. So why would you want to dilute it with an investment that pays back less? You don’t, of course. You should only make additional investments if you expect the same return—a rule that applies as much to marketing as to any other investment.

This metric is a fantastic lens for making business decisions. Especially because it’s so simple. In fact, for some business owners, it’s the first truly practical marketing ROI framework they’ve ever had.

It also creates a common language so we can all communicate better. You already know how much I love getting together with other entrepreneurs at EO LA. We always find a way to help each other find a path forward, no matter how different our businesses may be. But the second we start talking financials, we suddenly start speaking different languages. No one can agree on the most important definitions. What’s great about Brandon’s framework is that anyone can use it, in any business.

How to apply the metric to an actual business scenario.

Brandon shared some case studies to illustrate his framework in action. Before I go there, I want to clarify when the framework is useful—and when it isn’t.

- The ideal use case is a well-established, profitable RIA or wealth industry business getting ready to launch a new organic growth effort.

- Your infrastructure needs to be fully operational and connected, with your CRM and marketing automation systems up and running. If you can’t track anything, you can’t assign accountability.

- It’s not meant for an entrepreneur starting a new business that needs basic table stakes before opening its doors—a name, a website, CRM, a marketing platform, key messaging, and so on. Those investments have much longer payback.

Assuming your business does fit the profile, let’s walk through how to use the framework.

First, as Brandon says, you have a decision to make: What’s your catalyst for growth?

If you have plenty of new business coming through the door, but don’t have the staff to service them, then people are your catalyst. Go hire talent. Forget about marketing budgets for now.

At FiComm, this is something we say all the time. Marketing can’t fix a broken business model. If you don’t have the right people, the right experience, and all the right fundamentals in place, it’s not going to matter how good we are at marketing strategy.

Let’s say you already have the right people, and what you need is revenue. You’re ready to consider a bigger marketing spend, assuming you can afford it. This framework will help you determine how profitable the increase in your spend is.

These are a few slides from Brandon’s case study—actual examples from one of his clients, disguised for anonymity.

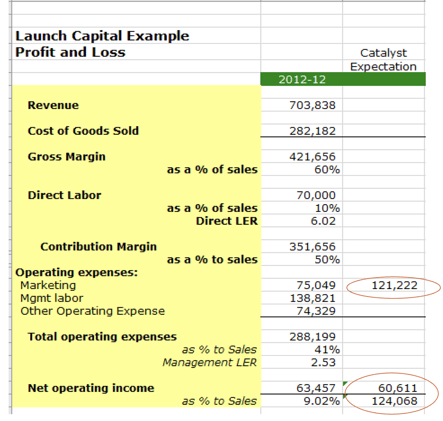

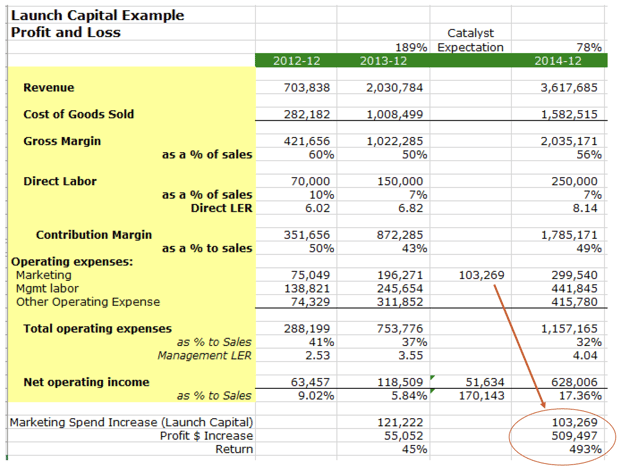

Here we have a business with $700K in revenue that’s spending $75K on marketing. The business plans to boost its marketing budget to $120K. (Brandon calls this “launch capital”—money you invest when you’re pushing a new growth initiative.) Everything else remains the same.

In return, the business expects a $60K increase in net income—an increase of 50% of current net income per Brandon’s metric.

After the increase in spend, profit actually rose $50K—not quite 50%, but still a very respectable 45% increase.

Marketing is rocket fuel for a business. Any time you succeed in lighting a fire under your growth, you should immediately pour more fuel on it. In that spirit, the business increased its marketing spend to $103K in the following year. Profit exploded to $628K.

It’s an amazing result. Over time, the business transformed from a sub-million-dollar revenue company into a $10+ million business, achieving phenomenal growth without sacrificing its bottom line—all by increasing its marketing spend. Investing more was the right move.

But more isn’t always more. There were times when this business increased its marketing spend too far, too fast. Afterwards, it fell short of its 50% profit return target. In response, it scaled back its budget to a more reasonable level.

This is how we keep marketing accountable. Accelerate spend on marketing when it’s boosting profits. Pull back when it isn’t.

So simple. Yet so transformative.

A different way to think about marketing.

You might wonder what this ultra-simple analysis does to all those metrics marketing agencies and departments like to talk about—impressions, views, click-throughs, and all that. I want to be clear. We still use those metrics at FiComm, especially when we want to set a baseline to track improvements or evaluate a campaign. Figuring out the impact on profits can take a year or more. That’s too long to wait when you need to know which email copy is working better this week, or if you need to pump podcast downloads. When it comes to tactics, we need quick and easy data points to guide short-term decisions.

But all those metrics are just rules of thumb. They aren’t the one measure that really matters: profit.

Why marketing people might feel defensive—but shouldn’t.

Talking about profitability makes a lot of third-party marketing firms and internal marketing staff feel nervous. They think, we don’t control all the variables that determine whether you turn a profit. Why should we be held accountable for it?

To be fair, that’s true. But there’s nothing here for marketers to be afraid of. What’s scarier is working in a silo where you don’t know what game you’re playing, or what the rules are, which is where most marketers find themselves. Profit gives everyone a common language for sharing the vision for the business. It levels the playing field, so that executives and marketers can have real conversations about expectations and accountability. This kind of transparency comes as a relief to marketers once they understand it. No one is looking to sabotage profits... ever.

The lesson: You can fuel growth without torching profits.

The 50% figure gives you a real-world data point to hold onto, but the number itself isn’t sacred. Your number may be higher or lower. Many of our largest clients develop their own internal hurdle rate and simply tell us what their target is.

What truly matters is the framework. It’s a dynamic system. Marketing is not a set-it-and-forget-it discipline. Businesses evolve. Strategy changes. Tactics change. As Jeff Dekko of Wealth Enhancement Group told me, all tactics work for all businesses at some point. It’s just a matter of when. You have to continually track the impact of your marketing on your profits, and adjust your spend accordingly.

That’s why FiComm takes the approach it does. We don’t constantly goad clients to increase their marketing spend regardless of results, which makes us a bit of an outlier in the industry. Instead, we try to be long-term partners, helping our clients experiment, evolve, and drive growth in a profitable way—always recalibrating, always adjusting.

----------------

I hope this framework inspires you see marketing planning in a completely new way. If you’d like to talk about how to apply the framework to your own budgeting process, connect with me on LinkedIn. I’d love to help you think through how it could impact your business.

You can find out more about Simple Numbers at SimpleNumbersCRI.com. Contact Brandon at Brandon.gray@simplenumberscri.com, or contact me and I’ll connect you with him.